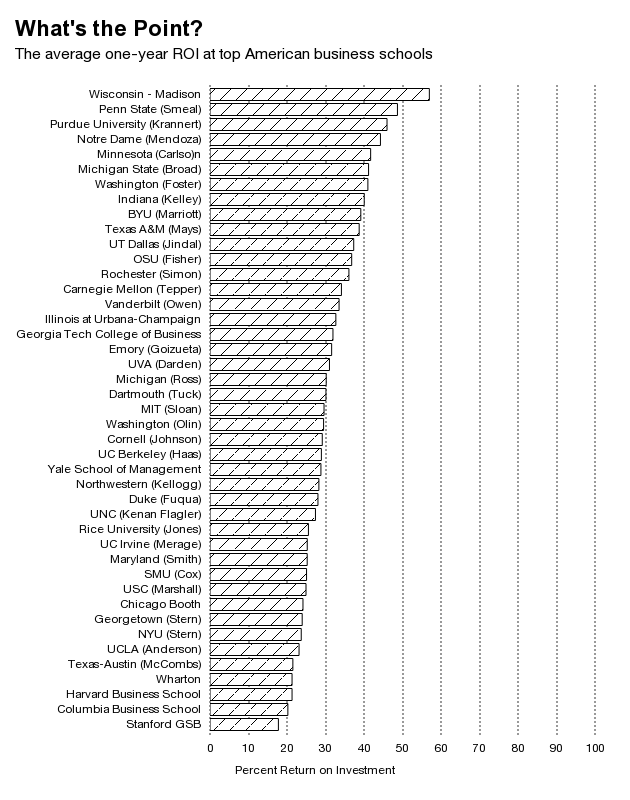

Prestigious business schools are very expensive and it takes their graduates longer, on average, to profit from their degrees that to those who choose more affordable, less-selective programmes, according to Bloomberg Businessweek data. So in numbers, what is the return of investment at top business schools?

[caption id="attachment_12102" align="alignnone" width="630"] Source: Bloomberg Businessweek[/caption]

Source: Bloomberg Businessweek[/caption]

Stanford MBA graduates earn back 18% of what they spent on school within a year of graduation. This is the lowest rate of any top MBA program, according to calculations on ROI at 43 out of the top 50 US business schools. Other top business schools in the US also account for a low return of investment. At the top eight programs whose tuition tops $120,000, graduates will recoup less than 30 percent of what they invested in school during their first year of post-MBA work. Students at highly ranked private MBA programs don’t benefit from their degrees as quickly or dramatically as others do.

Compared to the top schools, more modestly priced programs at public universities offer a larger payoff. At the University of Wisconsin-Madison, a two-year degree costs out-of-state students $56,000, and the average student earns back nearly 60% of what was spent on school within a year after leaving campus. At Penn State and Purdue, which come with a slightly higher price tag, MBAs get back close to half what they invested in business school the first year after graduation.

However, it should be noted that one year is a short time frame to measure the value of a degree that people will use for decades-long careers. The calculation may underestimate the worth of a school brand such as Stanford’s—or a school’s alumni network—to a young person embarking on a never-ending professional climb.

Keeping these calculations on return of investment in mind, we ask ourselves why students still rush to compete fiercely for the chance to get admitted in the U.S. at brand-name schools. One reason is that many go to business school less for the potential financial return than from a twentysomething desire to change course.

Going to business school can be profitable in ways that don’t show up on a paycheck, at least not right away. Name recognition and powerful alumni connections matter in an environment that values networking opportunities at least as highly as a degree.

Source: Bloomberg Businessweek

Comments